BEST Carlsbad Uninsured Motorist Accident Lawyer Near You

Have you been hurt in Carlsbad uninsured motorist accident? Were you in an accident with an uninsured driver? Did you incur thousands of dollars in medical expenses? Are you looking for a way to get those bills covered? If so, you need a knowledgeable uninsured motorist accident lawyer. You need an attorney who understands the nuances of insurance policies and can persuade even the most hesitating insurance companies to compensate you fairly.

We Are The Uninsured Motorist Accident Attorneys in Carlsbad, California at The Levinson Law Group

Our Carlsbad car accident law firm consists of the best and brightest injury lawyers who are steadfastly dedicated to helping injured clients move on with their lives after a major car accident.

While we have obtained significant six- and seven-figure settlements and jury verdicts, we pride ourselves in helping families overcome what, for many, is one of the most challenging experiences they will face. To learn more about your options, give The Levinson Law Group a call. We accept cases on a contingent fee. That means that if there is no recovery in your case, you pay no fee. And in most cases, we even advance the costs.

Injuries & Deaths from Uninsured Motorist Accidents in Carlsbad, CA

According to the National Safety Council, in 2019, more than 38,800 people were killed in car accidents, and another 4.4 million required medical care.

According to the American Automobile Association (AAA), in 2020, the average cost of car insurance across the country was just over $1,200 a year.

California is not among the states with the highest insurance rates. According to the Insurance Information Institute, California ranks 21st in terms of the highest insurance premiums, with the following average annual costs:

- Bodily Injury Liability: $565.70

- Collision Coverage: $458.88

- Comprehensive Coverage: $86.15

Rate of Uninsured Motorists in California

On average, a California driver pays about $957.08 per year in insurance.

In one form or another, car insurance is required in almost every state, including California. However, the number of motorists who drive without insurance is startling. While the rate of uninsured drivers fluctuates year-to-year, according to the Insurance Information Institute, on average, more than 13 percent of all drivers are uninsured.

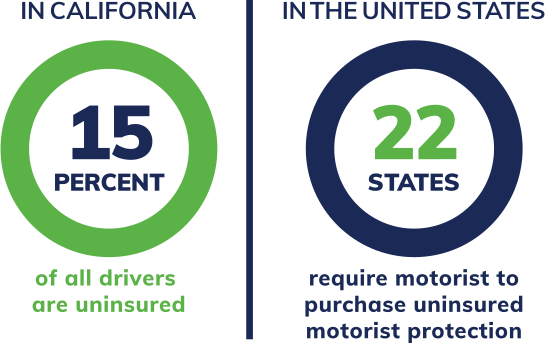

In California, uninsured drivers are an especially concerning problem, with an estimated 15.2 percent of all drivers being uninsured. This makes California 12th among the states for the highest rate of uninsured drivers.

In the United States, 22 states require motorists to purchase uninsured motorist protection. California is not among them.

California Car Insurance Requirements

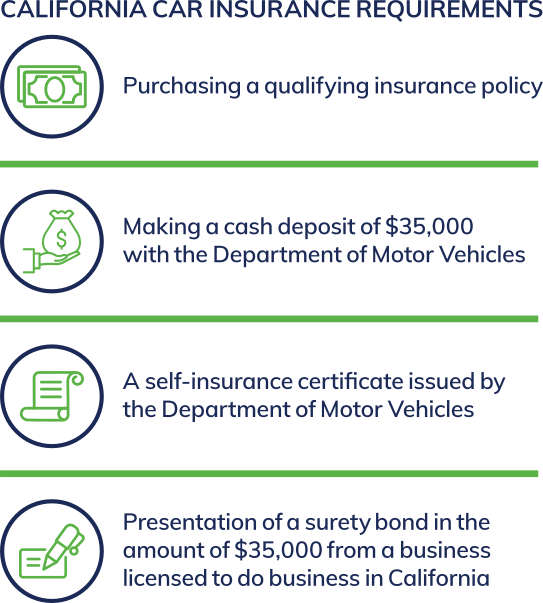

Like almost every other state, California requires drivers to obtain insurance or prove that they are financially able to cover the costs of an accident. California drivers have a few ways to comply with the state’s insurance requirements, including:

- Purchasing a qualifying insurance policy;

- Making a cash deposit of $35,000 with the Department of Motor Vehicles;

- A self-insurance certificate issued by the Department of Motor Vehicles; or

- Presentation of a surety bond in the amount of $35,000 from a business licensed to do business in California.

What to look for in a Carlsbad, California insurance

The vast majority of motorists end up purchasing an insurance policy through one of the many insurance companies that operate in the state. Under California Insurance Code §11580.1b, a qualifying insurance policy must provide at least the following amount of coverage:

- Bodily injury liability coverage: $15,000 per person and $30,000 per accident; and

- Property damage liability coverage: $5,000

California Insurance Code

When shopping for insurance policies, there is always a trade-off between the level of coverage and the cost of the policy. On the one hand, most want to keep their monthly premiums low. On the other hand, it is crucial to have sufficient insurance coverage in a major Carlsbad car accident.

Unlike some other states, California law does not require drivers purchase uninsured (UM) motorist protection or underinsured motorist protection (UIM). However, all insurance companies that write policies in California must offer this coverage. It is only if the company obtains a written waiver from the insured that an insurance company can write a policy without these coverages.

What Is Uninsured Motorist Protection?

Uninsured motorist (UM) protection is a type of insurance that covers a motorist’s damages if they are involved in an accident with a driver who does not have insurance. Underinsured motorist (UIM) protection is a related type of insurance covering an accident victim’s damages that exceed the limits of an at-fault driver’s policy. California law does not require drivers to purchase UM or UIM coverage.

Of course, motorists are allowed to purchase additional insurance. And it is generally a good idea to do so. Both UM and UIM coverage can be critical. In California, more than 15 percent of all drivers are uninsured. This means, if you are involved in an accident, chances are about one in seven that the at-fault driver will not have car insurance. And even if they do, the damages you sustain in the accident can easily exceed the at-fault driver’s insurance limits because many motorists only purchase as little insurance as possible to cut down on their monthly premium costs.

For an example of why UIM coverage is important, assume you are involved in an accident with another driver. The other driver, who was responsible for the collision, carried the minimum insurance allowed by law. However, your damages totaled $150,000. In this case, the at-fault driver’s insurance policy would only cover $15,000, or 10 percent of your damages. However, if you had UIM coverage, you could file a claim with your own insurance company to recover these damages up to the policy limit.

An example of a situation in which UM coverage is crucial is if you are hit by a driver who does not have insurance. Using the same facts as the above example, if the driver who hit you did not have any insurance, you would recover nothing from the insurance company unless you had UM coverage. Of course, you can pursue a legal claim against the at-fault driver; however, if they did not have insurance, the chances of them having enough assets to cover your expenses may be low. The result is that you could be left on the hook for all of your medical costs and other damages.

What to Do After an Accident with an Uninsured Motorist in Carlsbad, California

If you have been injured in a Carlsbad car accident involving an uninsured motorist, it is important that you consider your options to determine whether there is any way to recover for your accident-related expenses. Even if you do not have uninsured motorist protection, and are unsure whether you have a claim, take the following steps to preserve your rights in case you later decide filing a claim is your best option.

Report the accident

Extreme forces are involved in car accidents that can cause severe damage to the brain, including a traumatic brain injury. Head injuries are of special concern because they do not always result in symptoms. Often, an injured motorist will experience a headache, dizziness or nausea after an accident, and it is normal to attribute this to the stress of the accident. However, these symptoms could also be the early signs of a traumatic brain injury.

Inform your insurance company of the accident

Report the accident to your insurance company. While the primary means of recovery after an accident with an uninsured driver is through UM coverage, there may be other ways to get reimbursed for your expenses through your existing insurance policy. However, if you wait too long to inform your insurance company of the accident, you may be giving up the right to file a claim.

Obtain medical care

After an accident, you may or nor have visible injuries or physical symptoms. It is imperative that you get checked out by a doctor as soon as possible. Not only will this ensure that you obtain the medical care you need, but it will also document your injuries, making it harder for your insurance company to dispute the seriousness of the accident.

Be careful when talking to your insurance company

When talking with your insurance company, be cautious of what you say. While you may think that your insurance company is looking out for your best interest because you are their customer, that is not the case. Insurance companies are always looking for ways to deny a claim or limit the amount of money they need to pay to settle a claim. It is especially important that you do not admit fault or explain that you wish you would have done something differently.

Reach out to an attorney

When you are ready, reach out to a Carlsbad uninsured motorist lawyer for assistance. An attorney can help you determine what your options are and how best to pursue them. Even if you do not have UM coverage, there may be other ways that you can get reimbursed for your accident-related expenses.

Won’t My Health Insurance Cover My Medical Bills?

If you do not have UM coverage but have health insurance, your health insurance policy may cover some accident-related expenses. However, the problem with looking at your health insurance policy is that you will be responsible for all co-pays and deductibles. Depending on the extent of your injuries and your health insurance coverage, these costs can be significant.

Reach Out to a Dedicated Uninsured Motorist Accident Lawyer Near You in Carlsbad, California

If you have recently been involved in a Carlsbad car accident with an uninsured driver, do not assume that you will be responsible for all of your expenses. You very likely have options. At The Levinson Law Group, our knowledgeable team of car accident attorneys will work closely with you to determine your options and how you can best pursue them. We recognize that—on top of the injuries you’ve suffered—dealing with an uninsured driver is extremely frustrating, and we are here to assist in any way we can. We also serve all the surrounding areas close to Carlsbad, CA, so whether you need an injury lawyer in Menifee, CA or a car accident attorney in Julian, CA we are here to help.

When you decide to work with The Levinson Law Group, you can rest assured that you will have someone in your corner throughout the entire process. We begin by explaining the recovery process in understandable terms and make ourselves available to answer your questions whenever they come up. To learn more about your options, give The Levinson Law Group a call at 760-827-1700. We accept cases on a contingent fee. That means that if there is no recovery in your case, you pay no fee. And in most cases, we even advance the costs.